SMALL BUSINESS

Small-Business Owners Feel Weight of Personal Debt Guarantees

Promises to cover business debts loom large after pandemic shutdowns; ‘It’s like trying to stand in quicksand

The vise is tightening on owners of restaurants, fitness centers and other small U.S. businesses trying to hold on until the economy fully reopens. And unlike at most big companies, the burden is often deeply personal.

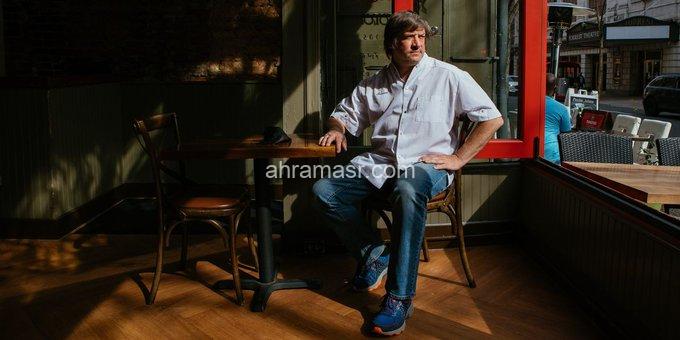

Townsend Wentz borrowed from his family to open his first Philadelphia fine-dining restaurant in 2014. The chef tapped the equity in his home, erased any semblance of a retirement account and diverted college funds for his daughter into his business. Roughly $1.5 million in personal investment now sits in the balance. The pandemic repeatedly closed his five locations for portions of the year.

On top of that, Mr. Wentz, 53 years old, has a personal guarantee on one location that makes him responsible for around $540,000 in rental payments over five years and an additional $175,000 for a liquor license. The guarantee weighs on Mr. Wentz as he juggles phone bills, tax obligations, rental payments and other expenses.

“It’s like trying to stand in quicksand,” he said. He hopes to have all of his

192 RESPONSES